Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

February 10, 2025

Bitcoin is being recognized and adopted by increasingly more retail and professional investors. To manage their BTC funds properly, they can learn various best practices that help store and use BTC more safely and efficiently.

Bitcoin's UTXO model, which the cryptocurrency uses to keep track of BTC balances, is one of the key concepts that can be mastered.

Read on to learn about UTXOs, or Unspent Transaction Outputs, and how proper management of UTXOs can save you on fees and preserve privacy.

Bitcoin UTXOs are specific amounts of BTC you receive in your wallet that are available for spending. For example, if you have a balance of 0.1 BTC, it may consist of several UTXOs, similar to how separate USD bills are kept in your traditional cash wallet.

Therefore, the 0.1 BTC balance can be made of different sizes of UTXOs, such as 0.04 BTC, 0.05 BTC, and 0.01 BTC.

Each of the UTXOs in your wallet can become a part of future BTC transactions.

In Bitcoin transactions, your wallet checks all the available UTXOs you hold and combines the most suitable ones to reach just the right amount for the transaction being sent. However, since UTXOs can’t be divided in your wallet before sending, the transaction might involve a larger amount of BTC, while you receive the excess amount back as a change. It is similar to how you would pay $10 and $5 bills for an item that costs $12 and receive $3 as a change.

In the case of BTC, if, for example, you need to send 0.7 BTC and you have two UTXOs of 0.4 BTC and 0.6 BTC, your wallet will create a new UTXO of 0.1 BTC. Then, the recipient receives the needed 0.7 BTC, and your wallet receives back 0.3 BTC. Now, 0.7 BTC and 0.3 BTC are two new UTXOs in separate wallets.

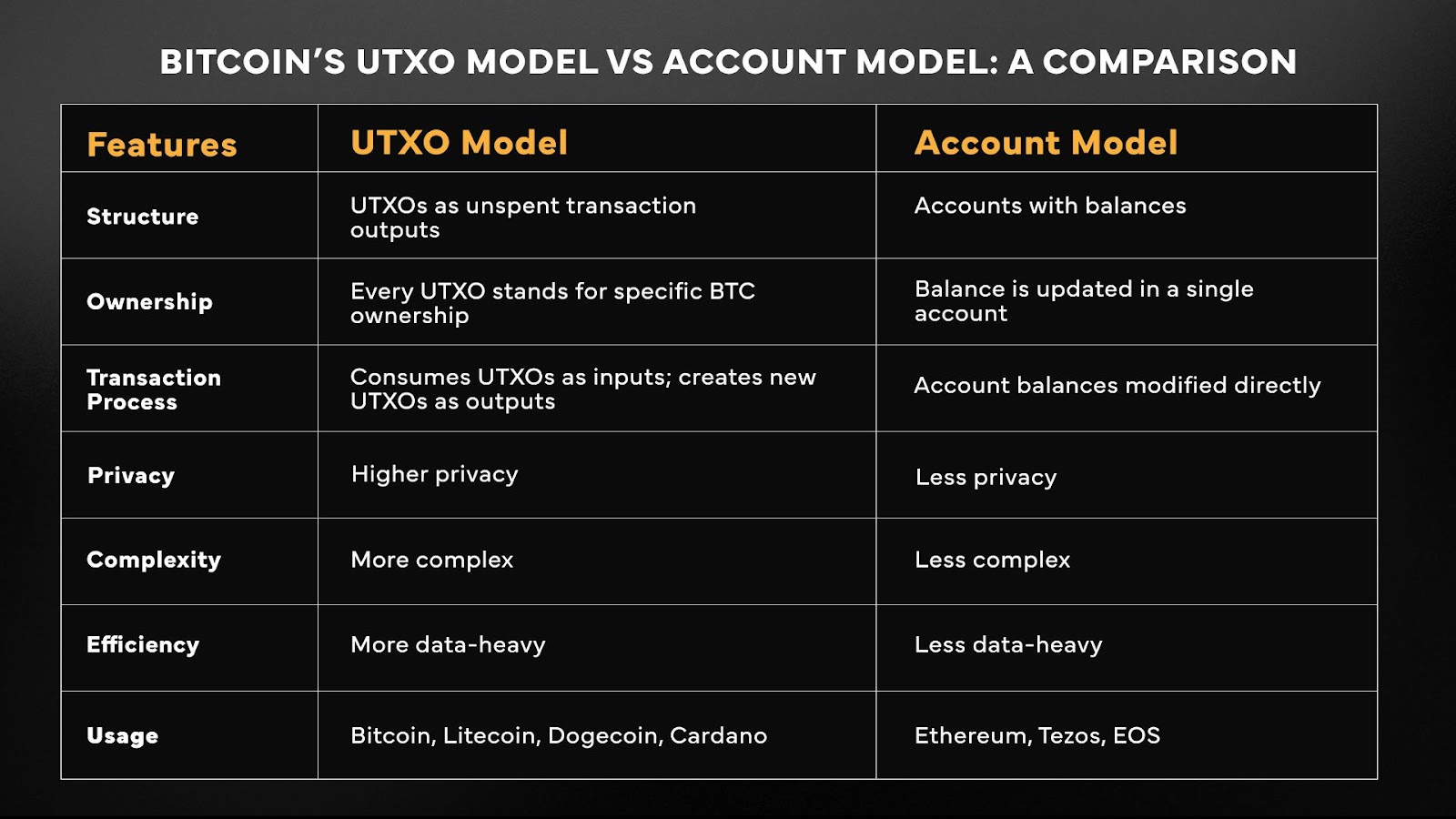

The UTXO protocol isn’t the only transaction model used by cryptoassets. There is also the Account-based model developed by the Ethereum team, and used by the likes of Ethereum, BNB Chain, and Solana, among others.

Here are the main differences between the two:

The balance in the UTXO model consists of all unspent outputs from past transactions, while the account-based protocol is similar to traditional banking. In the account-based model, the system removes the needed amount from one account’s balance and adds it to another.

Furthermore, Bitcoin’s UTXO method is considered to be more transparent, secure, and more private. However, it requires more data and is more complex. On the other hand, Ethereum’s account-based approach is simpler but potentially at the expense of privacy and security.

Bitcoin creator, Satoshi Nakamoto, chose the UTXO model due to the security and transparency it provides. This concept attracted the interest of Nakamoto after it was independently created by two developers, who also became prominent Bitcoin pioneers, Adam Back and Hal Finney.

Specifically, using UTXOs as individual pieces of BTC allows for precise authentication of the transactions and prevents tampering. Also, they boost privacy, as there are new UTXOs created after every transaction–less likely to be linked to previous transactions and reveal all your BTC funds if the address is not being reused.

In addition, Bitcoin nodes keep track of all UTXOs on the blockchain to prevent double-spending, something that had thwarted earlier endeavors to create a decentralized digital currency.

UTXOs impact your transaction costs and privacy. Therefore, understanding UTXOs and their management can help you save on fees and preserve privacy, while at the same time organizing your wallet and protecting it from ‘Bitcoin dust’-related risks in your wallet.

As each BTC transaction involves a network fee, its size depends on the number of UTXOs involved, not the amount of Bitcoin being sent.

The more UTXOs your wallet needs to bring together, the more data is involved, and the higher the costs are.

In our cash purchase comparison, this would be like paying for something in a bunch of small bills and coins. This would require more time and effort collecting them all and counting them. Therefore, the more UTXOs, the more effort and fees involved.

‘Bitcoin dust’ refers to small amounts of UTXOs that are way too little to be cost-effective, as the fees would simply outweigh their worth. It’s like spending $10 on a bus ticket to get to another city to collect $1 you left somewhere in a park.

Over time, these tiny UTXOs can grow in number, making it increasingly more difficult to spend without transaction costs outweighing their worth. They essentially become unspendable.

Properly managing UTXOs in your wallet is all about keeping tabs on those individual fragments to reduce future BTC transaction fees, strengthen privacy, and avoid the Bitcoin dust buildup.

Much like with cash, managing UTXOs involves tidying up your digital wallet to avoid the tiny, hard-to-spend fragments of bitcoin while also avoiding keeping too large UTXOs for privacy reasons.

While all bitcoin users can benefit from UTXO management, two specific groups must pay more attention:

Consolidating UTXOs involves bundling up smaller bits into larger pieces, similar to how spare change can be exchanged for larger bills. UTXO consolidation follows much the same basic principle, allowing you to turn tiny pieces of BTC into bigger, more manageable UTXOs.

Tips for UTXO consolidation:

Certain wallet software solutions, like the Bitcoin Core client originally created by Nakamoto, store, and index UTXO metadata using a LevelDB database. This way, they enable faster and more efficient tasks of locating UTXOs. But there are now an increasing number of wallets that offer these features as on-chain fees are expected to only go higher as Bitcoin adoption grows.

The Bitcoin UTXO model may sound complicated, but it’s really just a simpler way to keep track of your BTC funds.

Understanding how it works can help you save money on transaction fees, manage privacy, avoid Bitcoin dust that is difficult to spend, and keep your wallet running smoothly and securely.

Other than Bitcoin, cryptocurrencies like Litecoin, Bitcoin Cash, Cardano, and Dogecoin use the UTXO model.

The UTXO model edges out the account-based model due to better privacy, security, and a high level of accuracy. That said, it involves a bit more data management than the account-based model.

The account-based model is like a running balance, while UTXO treats each received BTC transaction in your wallet as an individual ‘coin’ to be spent. The former is simpler and faster, but the latter offers more security and privacy.

While there is no strict maximum, as all Bitcoin transactions, UTXOs are also limited by Bitcoin blockchain’s block size of 4 megabytes.

Data about UTXOs are spread across the blockchain, with each Bitcoin node keeping a record of every unspent UTXO. In other words, Bitcoin UTXOs are stored in blocks as parts of transactions.

For smoother transactions, it’s ideal to consolidate UTXOs into sizes that are at least a few thousand satoshis. However, going forward, some sources recommend to prepare at least 1 million satoshis (0.01 BTC) UTXOs as on-chain fees are expected to grow. However, UTXOs shouldn’t be large enough to expose a significant amount when spent as all transactions on the Bitcoin blockchain are public.