Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

September 30, 2025

BitcoinFi, or BTCFi, refers to DeFi applications built directly on the Bitcoin blockchain or on Bitcoin Layer 2s.

In this guide, you’ll learn what BitcoinFi is, how it differs from traditional DeFi, what you can do within the ecosystem, and which projects are currently the biggest movers.

BitcoinFi, also known as BTCFi, is the decentralized finance ecosystem built on Bitcoin.

From decentralized trading and lending to liquidity provision and yield-generation, the BTCFi ecosystem offers a wide range of Internet-native financial services, all powered by or secured by Bitcoin.

As of August 2025, the total value locked (TVL) of the BitcoinFi ecosystem sits around $6.73 billion, with a large share driven by staking protocols. Bitcoin is also still used for payments, with the Lightning Network making up almost half a billion dollars of the total TVL.

BitcoinFi operates on both Bitcoin Layer 1 and Layer 2.

Layer 1 solutions refer to DeFi projects that are built directly on the Bitcoin network, with no separate blockchain of their own. Assets such as Runes and Ordinals, for example, can be traded directly on the Bitcoin mainnet thanks to BTCFi protocols, such as LiquidiumWTF and Odin.fun.

Most BTCFi applications, however, call Bitcoin Layer 2 their home. Layer 2 solutions operate on top of Bitcoin but process transactions off-chain or on a separate linked blockchain. These systems anchor to Bitcoin for security, but may introduce new features and functionalities, such as complex smart contracts that enable advanced DeFi services, including autonomous trading pools. For example, ALEX on Stacks or Sovryn on Rootstock offer a range of BitcoinFi services on Layer 2 protocols.

The BitcoinFi ecosystem offers a broad range of financial tools, including some blockchain-native and others that originate from traditional finance (TradFi).

Here’s a look at some of the key things you can do in BTCFi.

You can use BTC as collateral to borrow other assets, or use another asset to borrow Bitcoin. Alternatively, you can lend out your BTC and receive yield in the form of interest or collateral in case the loan defaults.

Decentralized trading generally happens in two main ways: through peer-to-peer exchanges or via liquidity pools. In peer-to-peer systems, two participants trade among themselves with no centralized intermediary.

More commonly, automated market makers (AMMs) use liquidity pools to match asset pairs for traders, while liquidity providers receive a portion of the trading fees. In this sense, AMMs work like traditional order books but replace the central authority with smart contracts that handle transactions.

On the other side of AMM is liquidity provision. Someone has to offer up part of their holdings to keep trading pools liquid. In return, liquidity providers earn a portion of the pool’s fees as an incentive. The greater the demand for a particular asset or pair, the higher the rewards.

Bitcoin uses a Proof of Work consensus mechanism, which relies on mining to create and broadcast new blocks. However, some Bitcoin Layer 2s use Proof of Stake. In these instances, validators lock up a certain amount of tokens to participate in the network’s governance and receive a portion of the transaction fees in return. Leveraging this concept, some BTCFi protocols now offer BTC staking where investors can deposit native BTC to receive tokenized BTC as staking rewards.

Bitcoin NFTs are non-fungible tokens built on Bitcoin, most commonly (but not exclusively) using Ordinals. Ordinals enable individual satoshis to be inscribed with unique data, turning them into one-of-a-kind digital assets. The biggest difference between traditional NFTs and Bitcoin-based NFTs is that on Bitcoin, all NFT data is stored directly on-chain.

Bitcoin-native assets refer to any tokens or digital collectibles that exist on the Bitcoin blockchain. The concept is relatively recent, kicked off by Ordinals, which launched in January 2023. This was quickly followed by the experimental BRC-20 standard for fungible tokens in March 2023, before the launch of the Runes Protocol in April 2024.

Here are three of the most promising protocols operating within BTCFi ecosystems.

Babylon is a Bitcoin-native staking protocol. In short, it allows both new protocols and stakers to take advantage of the Bitcoin network’s size, security, and immutability, while reaping the benefits associated with Proof of Stake.

LiquidiumWTF is a Bitcoin-native borrowing and lending platform. It allows users to put up Bitcoin-native assets (Runes, Ordinals, and BRC-20 tokens) as collateral to borrow BTC. Lenders can earn interest on their BTC or receive the collateral should the loan default.

Odin.fun is a Bitcoin token launchpad and trading platform specializing in meme coins built on the Runes Protocol. Users can etch and mint Runes directly through the platform as well as participate in general trading activities.

BitcoinFi comes with its own share of benefits and drawbacks. Here are some of the key points to be aware of.

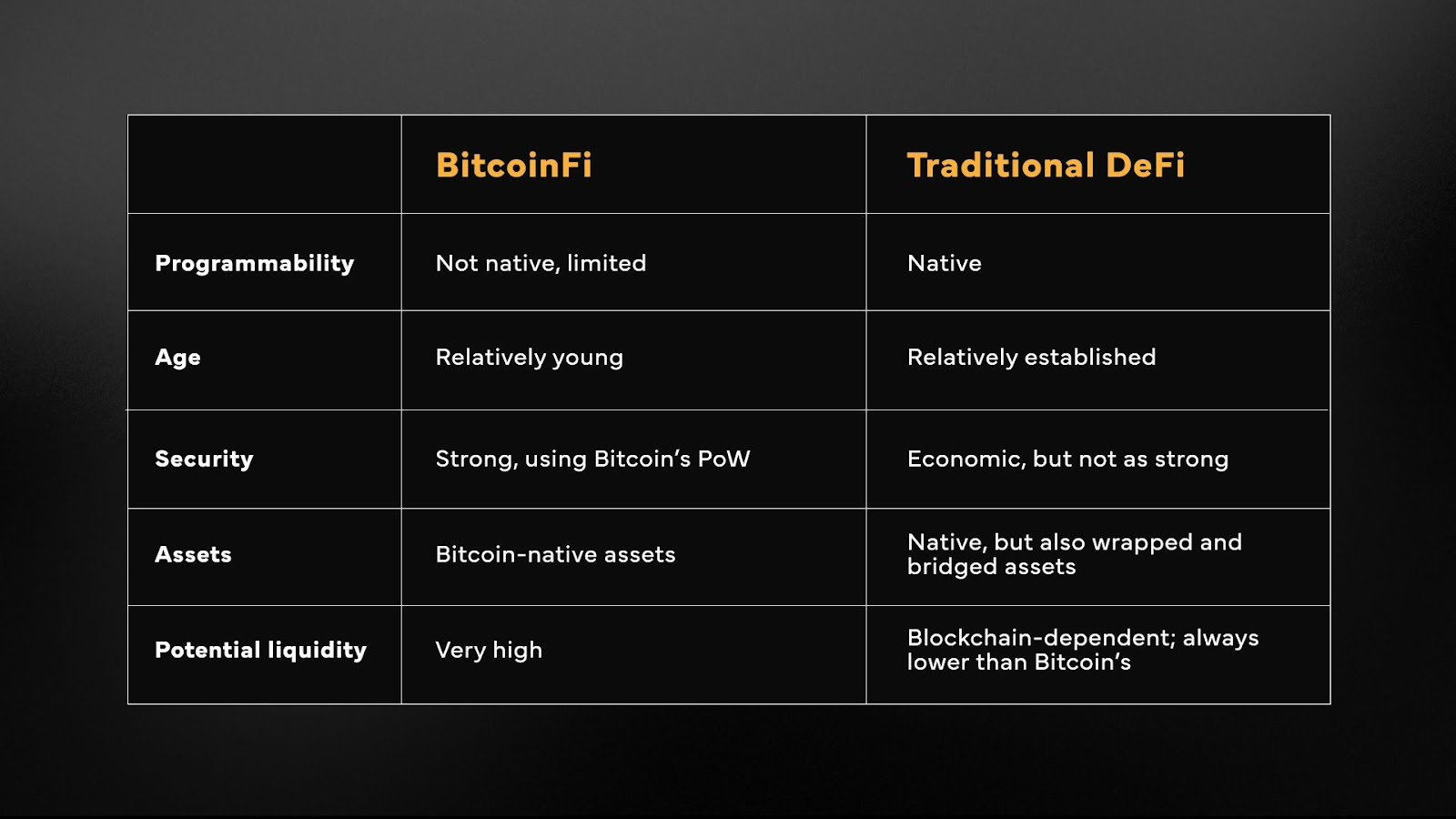

The table below shows how BitcoinFi compares to other DeFi ecosystems, which include but are not limited to those on the Ethereum blockchain and its associated Layer 2s.

BitcoinFi is still in its early days, but has already changed perceptions of BTC, shifting it from being seen solely as a store of value to functioning as a multi-purpose asset driving a whole, self-sustained economy.

As the ecosystem matures, collaboration between developers and the wider crypto community will likely lead to new and diverse use cases.

BTCFi refers to BitcoinFi, otherwise known as Bitcoin DeFi or decentralized finance on the Bitcoin blockchain. In short, it’s an ecosystem comprising different financial instruments and tools all built on Bitcoin.

Yes, BTCFi and BitcoinFi refer to the same thing. The abbreviations are used interchangeably throughout the community. The choice you make depends simply on personal preference.

Disclaimer: None of the information in this article should be considered investment advice. Investors should consult their financial advisors to determine if any of the financial products and services mentioned in this article are a potential fit for their portfolios or not.