Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

July 1, 2024

Stay up to date with our monthly market commentary:

The price of Bitcoin (BTC) decreased by 9.9% in June, ending the month just above the $61,500 level.

This is only the second down month for Bitcoin in 2024. The explanation for why it happened is clear. About a decade ago, over 70% of all the Bitcoin in circulation was traded on the Bitcoin exchange Mt.Gox. The Bitcoin investor community was shocked at the time when they discovered that 85,000 BTC had been stolen due to a system hack. The exchange had to shut down in 2014 and ever since, creditors have been waiting for a payout of their coins.

In June, the Mt. Gox rehabilitation trustee announced announced an update on the repayment schedule, and we know now that payouts will commence in July and last until October.

Over $9 billion worth of Bitcoin (BTC) and $50 million worth of Bitcoin Cash (BCH) will be redeemed. This event has hung over the heads of Bitcoin investors for years now and has always been a concern in the community. It was also evident this month and led to an increase in selling pressure.

The second event that increased selling pressure this month was a transaction of 6,500 BTC by the German authorities from a seizure of an illegal movie streaming site earlier this year.

Although the recent price plunge is nothing to be joyous about, knowing that the huge question mark of Mt. Gox could finally be solved and that seized Bitcoin is finding its way back into circulation could be a positive sign for the future health of the Bitcoin market.

After all, towards the end of the month, the price stabilized and started increasing again, alongside inflows into the spot Bitcoin ETFs.

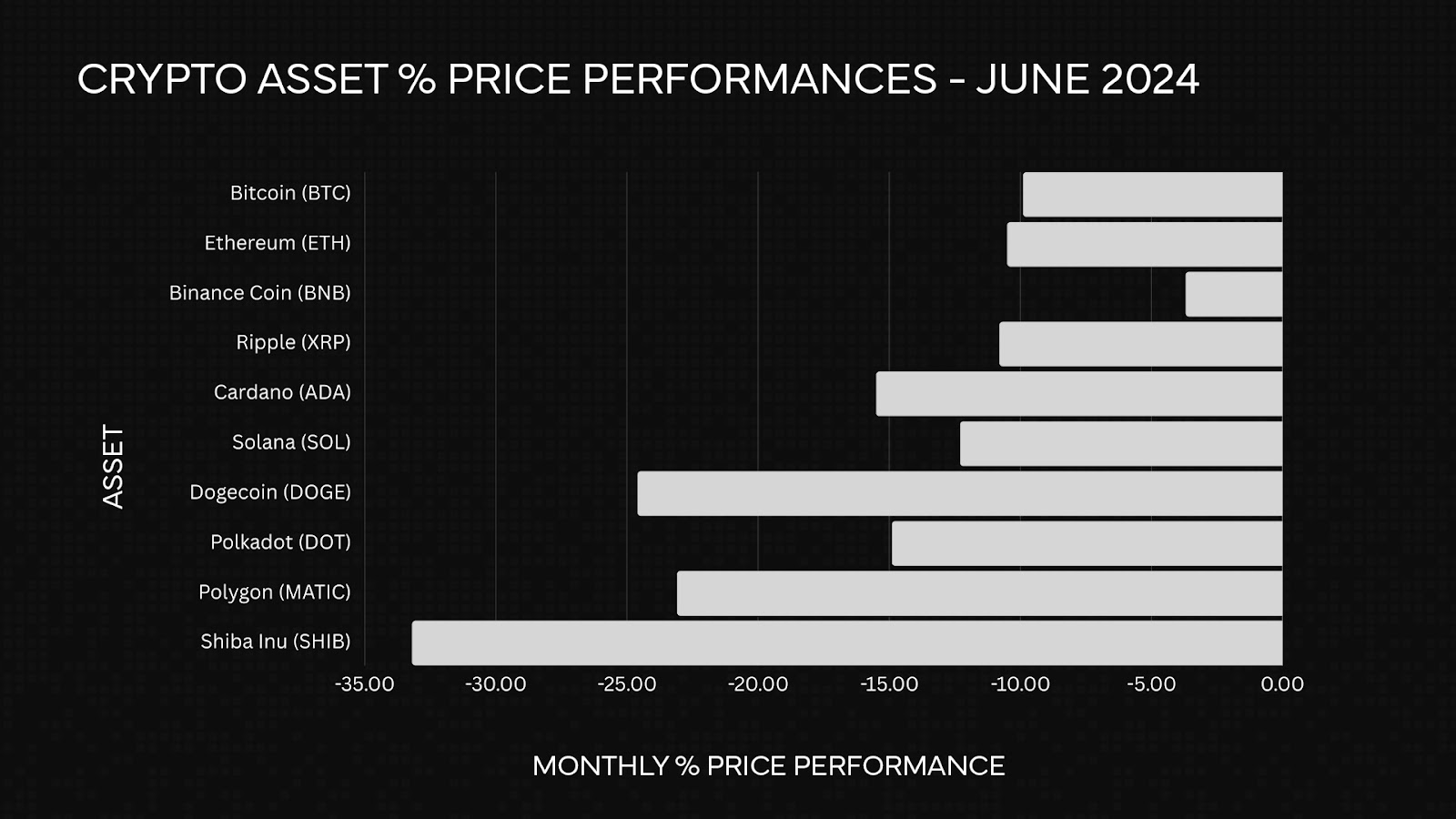

The crypto asset markets finished the month a leg lower, with some of the top 10 assets by market capitalization dropping by more than 15%.

Bitcoin (BTC) saw a monthly drawdown for the second time this year, closing 9.9% lower month-on-month.

Bitcoin’s price plunge this month is due to two key events. The first was Mt. Gox’s repayment oversight board announcing they will begin repayments in July to the victims of the hacked exchange over a decade ago.

A total of $9 billion will be repaid in Bitcoin and $50 million in Bitcoin Cash. The announcement triggered a series of liquidation events on exchanges, at points reaching record-low volumes for the entire month. As a result, the price briefly plunged to under $60,000.

The second key event was a transaction by the German authorities, who sent 6,500 BTC to Kraken and Bitstamp. These coins were from a seizure of an illegal streaming website earlier this year when law enforcement confiscated 50,000 BTC. This event also sparked further liquidations and increased the selling pressure on crypto exchanges.

Bitcoin’s negative performance also impacted the broader digital assets ecosystem, as most of the prominent coins saw price plunges. The only token that held relatively steady was Binance’s native token (BNB). Earlier this month, BNB surpassed its previous all-time high, crossing the $700 mark.

The remainder of the altcoin community was not as lucky as BNB. Many of the most prominent projects, such as Cardano (ADA), Solana (SOL), Dogecoin (DOGE), or Ripple (XRP), dropped by more than 10%.

June was an eventful month for miners and manufacturers of mining products.

Bitmain, one of the biggest producers of ASIC mining machines, announced its new Antminer L9. The newest edition to its product offering will hash even faster at 210 J/G, enabling miners to optimize their facilities.

The second announcement was the proposed acquisition between publicly traded mining companies Riot Platforms and Bitfarms. The latter announced a defense strategy against Riot, which previously acquired 12% of its competitors' overall shares. Riot proposed a buying price in April, but Bitfarms' board of directors declined.

The strategy lays out a timeframe until September 10, when a buyer must acquire more than 20% for a company takeover. Bitfarms hopes to fend off Riot and still maintain control over the company.

Such acquisitions happen regularly within the Bitcoin mining market, especially during global hashrate drops. Acquiring a competitor and its infrastructure is less expensive and complex than buying everything brand new or setting up new mining operations from scratch.

June was an eventful month for institutional digital asset investors, with the launch of a new spot Bitcoin ETF in Australia and inconsistent out- and inflows in the spot Bitcoin ETFs in the U.S.

Yet another market announced a spot Bitcoin ETF. This time, it's Australia, where the VanEck Bitcoin ETF started trading on June 19 on the ASX exchange with a seed investment of A$985,000. The product is a feeder fund for the VanEck Bitcoin Trust in the U.S.

So far, it’s the only spot Bitcoin ETF that has received the green light from the Australian regulator, while Sydney-based BetaShares Holdings Pty and DigitalX Ltd. are also lining up for a listing.

All Wall Street ETF issuers recorded inconsistent out- and inflows in June. While the month started great with daily net inflows during the first week, the markets reacted negatively following the Fed’s June 12 announcement.

All ETFs recorded net outflows for the first time in a month and continued to see that trend for the next two weeks. Bearish announcements, such as the Mt. Gox sale or the sale of seized Bitcoin by the German authorities, likely impacted the outflows.

Michael Saylor announced an additional purchase of 11,931 BTC, bringing the Bitcoin on Microstrategy’s balance sheet to 226,331 BTC.

MicroStrategy’s continuous buying of Bitcoin as a treasury asset highlights the digital currency’s use case as a cash reserve alternative for corporate treasuries.

*Closing price data is from June 27, 2024