Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

October 1, 2024

Stay up to date with our monthly market commentary:

The price of Bitcoin (BTC) increased by 10.5% in September, ending the month at $65,850.

For most of September, Bitcoin moved sideways, remaining in the high 50,000s. However, everything changed when Federal Reserve Chairman Jerome Powell took the stage on September 19 and announced a 50 bps rate cut.

Global markets reacted positively, with equities and digital assets leading the charge. In the seven days to follow, prices of the top ten crypto assets soared. What initially appeared to be a slow month quickly turned around, and Bitcoin closed the month with its best September price performance since the cryptocurrency’s inception.

Bitcoin’s price performance also helped the Bitcoin ETFs, which experienced substantial inflows towards the end of the month. Since September 19, all spot Bitcoin ETFs recorded net positive inflow days, with the last week in September recording a weekly total inflow of $1.11 billion.

There was also some exciting news from a regulatory perspective.

The SEC approved a rule change that allows the listing and trading of options contracts on BlackRock’s highly popular spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT). This will allow Bitcoin ETF holders to hedge their risk or take leveraged directional bets, further enhancing the Bitcoin trading ecosystem for large investors.

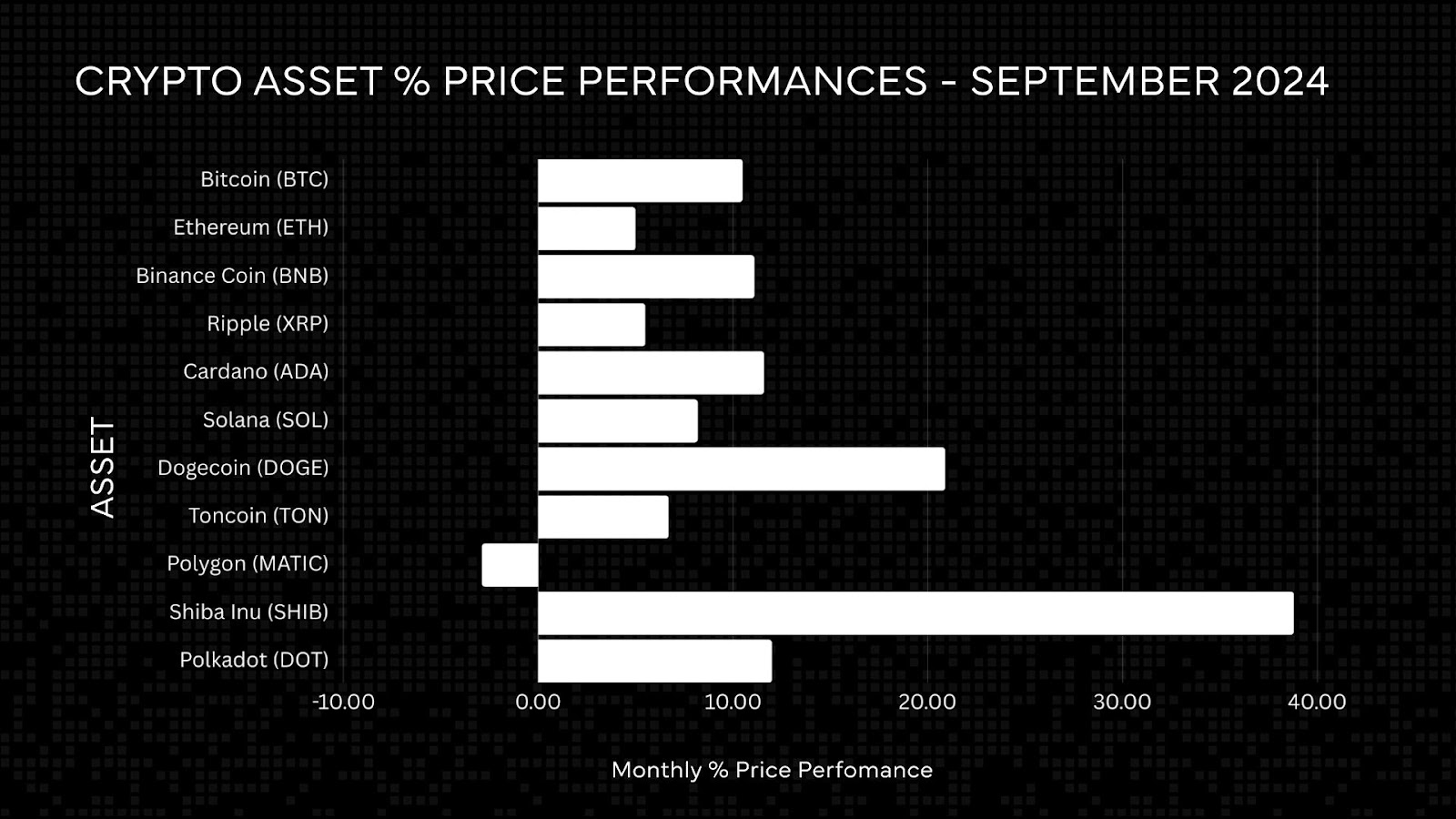

The crypto asset markets finished the month a leg higher, with some of the top ten assets by market capitalization rallying by more than 10%.

Historically, September is known as a down month for Bitcoin (BTC), yet this year is different. Following the U.S. Fed rate cut announcement, the price of Bitcoin rallied by 10.5% to pass $65,800.

In addition to Bitcoin, Ether also rallied, finishing the month 5% higher. This increase is due to the overall rise in liquidity, positive market sentiment for digital assets, and net inflows in the spot Ether ETFs. After weeks of outflows, the total inflows reached more than $85 million.

The largest gainers this month were the two leading memecoins, Shiba Inu (SHIB) and Dogecoin (DOGE), which closed the month 30% and 20% higher, respectively. Both coins saw an increase in trading volume as memecoins remain a popular choice among crypto traders during this year’s bull market.

The remainder of the top crypto assets market followed suit and finished the month largely in the green.

Bitcoin Layer 2s continue to make waves, with Bitcoin scaling solutions such as Ark and Lightning offering new developments.

The Lightning network is the most prominent scaling solution in the Bitcoin community. It is fast and significantly cheaper than regular on-chain transactions. However, it also requires liquidity, as users lock in their Bitcoin in payment channels, and the network will not allow payments to settle if there's not enough Bitcoin.

Ark was introduced to solve this issue by offering the same infrastructure as Lightning, but instead of relying on a user’s liquidity, the Ark protocol has Ark Service Providers (ASPs) who maintain the infrastructure.

Ark has been in development for six months, with one of the first applications released this month. Second Tech is the first service provider to offer both Ark and Lightning in a simple plug-and-play fashion.

Going forward, developers can offer both Ark and Lightning, potentially bringing Bitcoin to even more users worldwide and helping with mass adoption through scaling solutions.

September was an eventful month for institutional investors. BlackRock managed to get options for its IBIT Spot Bitcoin ETF approved by the SEC, and it is currently waiting for other government bodies to approve it as well. Additionally, BNY Mellon could soon be able to custody digital assets for its clients.

BlackRock’s IBIT spot Bitcoin ETF has not only been the most successful ETF launch in Wall Street history but is also the first to get the green light from the SEC for options trading.

The world’s largest asset manager is now in discussion with the OCC (Office of the Comptroller of the Currency) and CFTC (Commodity Futures Trading Commission), as these approvals are needed before the funds are listed officially.

BlackRock is the biggest spot Bitcoin ETF issuer, with around $23 billion in assets under management (AUM) for IBIT.

Since the release of the Staff Accounting Bulletin 121 (SAB 121) in March 2022, financial institutions that custody digital assets for their customers have to report the assets as liabilities on their balance sheets.

SAB 121 requires institutions to hold digital assets as liabilities on their balance sheets as long as they’re the sole entity responsible for managing private keys and custody of the assets.

While some public companies and institutions hold digital assets, such as Coinbase or MicroStrategy, banks have been reluctant to do the same. However, this might change soon in light of BNY Mellon's announcement this month.

The New York-based bank has been in talks with the SEC to custody digital assets in the name of their clients, beyond the exposure they might have to spot Bitcoin or Ether ETFs. They presented a plan to the SEC to ensure the safety of the assets they would safeguard.

It seems like the custodian bank’s work has paid off, as SEC chairman Gary Gensler noted: “Several banks and brokers have been in discussions about potential digital asset custody structures that would segregate customer assets from the banks and thus could also avoid the requirements of Staff Accounting Bulletin 121, the measure laying out the agency’s balance sheet requirements for crypto.”

Gensler credited BNY for doing a good job ensuring client assets are segregated from their own to ensure they wouldn’t be at the end of the queue in the case of bankruptcy.

While BNY Mellon still needs to wait for the final approval to custody digital assets, news such as this is another step towards outright crypto custody by large financial institutions.

MicroStrategy’s Michael Saylor announced an additional purchase of 7,420 BTC, bringing the Bitcoin on the technology company’s balance sheet to 252,220 BTC.

MicroStrategy’s continuous buying of Bitcoin as a treasury asset highlights the digital currency’s use case as a cash reserve alternative for corporate treasuries.

*Closing price data is from September 28, 2024 at 11:30 CET